How to Protect Yourself Against Coronavirus-Related Fraud

2020 Stimulus Package, COVID-19The global coronavirus pandemic has changed every single facet of our world – from the way we work to how we live our day-to-day lives – and we have been forced to quickly adjust to a new normal.

Unfortunately, there are those out there…

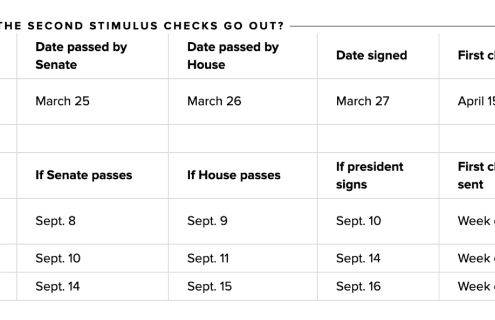

Second stimulus check payment schedule: How fast could the IRS send your money?

2020 Stimulus Package, COVID-19From CNET Personal Finance

If a final coronavirus relief bill passes, your second stimulus check could arrive more quickly than it did in the first round. We worked out some potential dates for when it could happen, based on what…

What President Trump’s Executive Order Means for You

2020 Stimulus Package, 2020 Tax Laws, COVID-19, Tax Credits, Tax Planning, Tax Tips, UncategorizedWe are still waiting for the dust to settle on what President Trump’s executive orders mean for taxpayers and business owners. There is a lot of talk about legal challenges and how Congress may react. But here is a summary of what we know…

IRS Cancels Stimulus Checks Issued to Decedents

2020 Stimulus Package, 2020 Tax LawsArticle Highlights:

Stimulus Payments to Deceased Individuals

Stop Payments Being Made on Checks Already Issued

IRS Authority to Deny Stimulus Payments to Deceased Individuals

History of Stimulus Payments

IRS Q&A Dealing…

What Led to Congress Extending the Paycheck Protection Program?

2020 Stimulus Package, Accounting, CARES Act 2020, COVID-19The economic uncertainty created in the outset of the Coronavirus pandemic was unprecedented, to say the least. This is a big part of the reason why, soon after the spread began, Congress took steps that were equally drastic - they passed the…

Is The Government Keeping Your Refund?

2019 Tax Laws, 2020 Stimulus Package, 2020 Tax Laws, Accounting, Tax Planning, Tax Refund, Tax Tips, Taxes

Article Highlights:

Bureau of the Fiscal Service

Allowable Refund Offsets

Disputing an Offset

Injured Spouse Claim

We all look forward to receiving our tax refunds, but what if you were expecting a refund and it never…

Employers, Don’t Miss Out on the Work Opportunity Credit

2020 Stimulus Package, Tax Credits, Tax Tips, Taxes, WOTC

Article Highlights:

Potential Credit

Eligible Employees

Credit Determination

Certification Process

Other Issues

The Taxpayer Certainty and Disaster Tax Relief Act of 2019 extended the Work Opportunity Tax Credit…

The IRS Is Issuing Some Stimulus Payments by Debit Card; Some Are Being Mistaken as Junk Mail and Thrown Out

2020 Stimulus Package, EIP Card, Stimulus PaymentsIf you are like most Americans, you receive tons of junk mail, which you tend to discard without ever reading. Well, if you haven’t already received your stimulus payment from the feds, maybe you shouldn’t be so quick to throw away those…

New $3 Trillion Coronavirus Relief Bill Proposed by House Democrats

2020 Stimulus PackageAs the coronavirus continues to lay waste to the American economy, legislators are hoping to provide additional relief and to shore up the country’s healthcare system. To that end, Democrats in the House of Representatives have proposed a…

Paycheck Protection Program and Health Care Enhancement Act: What’s In It?

2020 Stimulus Package, Business, CARES Act 2020PPP & The CARES Act

Following the passage of the $2.2 trillion CARES Act stimulus package at the end of March, one of the most talked about provisions was the Paycheck Protection Program (PPP). The CARES Act had earmarked $349 billion…